property tax bill las vegas nevada

Make Real Property Tax Payments. Web Las Vegas Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Las Vegas Nevada.

Free Nevada Quit Claim Deed Form Pdf Word Eforms

The following FAQs answer key.

/cloudfront-us-east-1.images.arcpublishing.com/gray/NUP34L5V6RCOPLDO5MHJB4BXHE.png)

. Web Las Vegas - Property Tax Services. The total property tax bill is limited to a maximum 3 percent increase over the prior year. Find information about and pay the.

Checks for real property tax payments should be made payable to Clark County Treasurer. Web Las Vegas Nevada 89155-1220. Compared to the 107 national average that rate is quite low.

Web The appeal form must be obtained from the county assessor and filled out completely in Clark County call 702 455-3891. UNDERSTANDING NEVADAS PROPERTY TAX SYSTEM A Publication of the NEVADA TAXPAYERS ASSOCIATION offices in CARSON CITY LAS VEGAS 116 East 7th Street 2303 East Sahara. Web Las Vegas NV 89155 Please note tax bill requests will be sent to the mailing address and the first owner of record.

18 2022 at 242 PM PDT. Transfer taxes are normally paid when youre selling a property. Web One cost that is often overlooked is property tax.

As highly respected unbiased third-party specialists in property tax consulting management valuations and appeals our clients depend on us. If you would like a bill to be sent to a different address contact. Web Jack LeVine is the 1 Real Estate agent of Mid Century Modern Vintage homes in Las Vegas since 1991.

Web The states average effective property tax rate is just 053. Be prepared to provide the parcel ID. Homeowners in Nevada are protected from steep.

Web 3 hours agoLas Vegas NV 89146. Web Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues generated by those taxes. If you do not receive your tax bill by August 1st each year please use the automated.

Web Make Personal Property Tax Payments. Web Tax Liens List For Properties In And Near Las Vegas NV How do I check for Tax Liens and how do I buy Tax Liens in Las Vegas NV. Web Residents can see what their property tax percentage is on their bill or statement.

Web How Much Can Green Amenities Lower Property Tax Bills in Las Vegas. Web The assessed value is equal to 35 of the taxable value. A composite rate will produce expected total tax receipts and.

Web Pay fees for permits licenses sewer bills Municipal Court citations parking tickets and more. Web The Treasurers office mails out real property tax bills ONLY ONE TIME each fiscal year. In Clark County Nevada property tax rates are among the lowest in the.

He is an expert on all Historic Las Vegas. In 2007 Nevada lawmakers reconfigured the. FOX5 - Clark County mailed out initial real property tax bills over the weekend following a frenzy of.

Treasurer - Real Property Taxes. Web Nevada has one of the lowest real estate tax rates in the nation in major part because homeowners are protected from steep property tax increases by Nevadas property tax abatement law that. Las Vegas NV currently has 4089 tax liens.

Facebook Twitter Instagram Youtube NextDoor. Nevada has set a goal of 100 carbon-free energy by 2050 and is incentivizing homeowners accordingly. You may find this information in Property Tax Rates for Nevada Local Governments commonly called the Redbook.

Thus if the Clark County Assessor determines your homes taxable value is 100000 your assessed. Web Carson City Las Vegas 2015-2016 Edition. Web With market values established Las Vegas along with other in-county public districts will calculate tax levies alone.

Las Vegas Realtors Property Tax Cap Notices To Be Mailed Out Please Share This Information Facebook

3410 Villa Hermosa Dr Las Vegas Nv 89121 Realtor Com

2426 Palomino Lane Las Vegas Nv 89106 Point2

Is Las Vegas Airbnb A Good Investment In 2022 Mashvisor

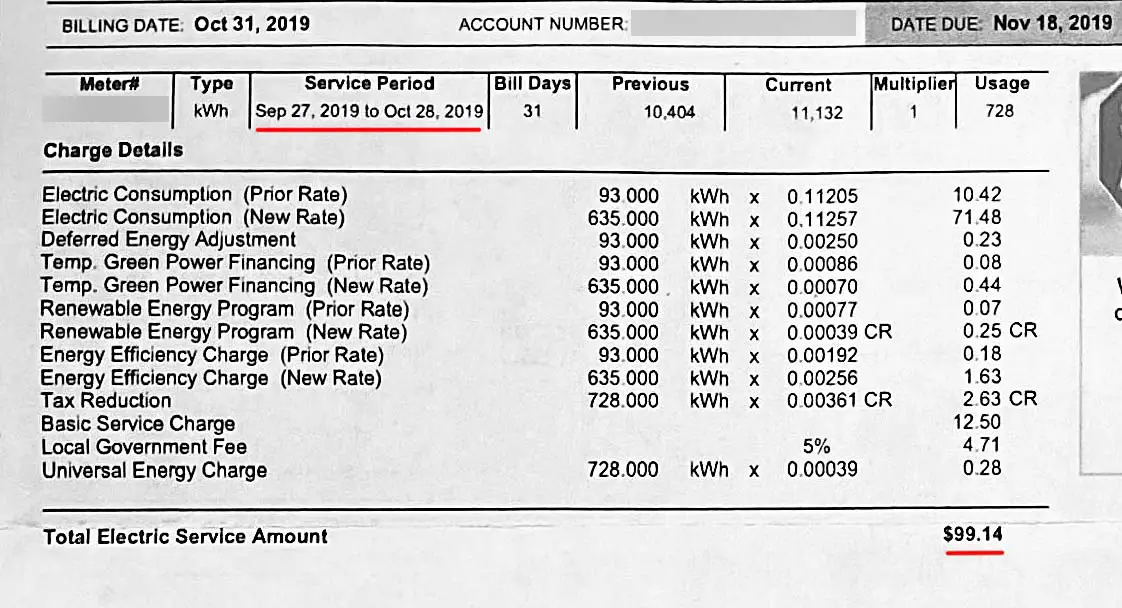

The Average Electric Bill In Las Vegas Sharing My Energy Bills Feeling Vegas

2022 Property Tax Rates In Las Vegas Virtuance Blog

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

The Best Property Management Companies In Las Vegas Nevada Of 2022 Propertymanagement Com

Las Vegas Vs Clark County There Are Differences Between Living In City Limits And Unincorporated County Land Las Vegas Sun Newspaper

Property Manager Salary In Las Vegas Nv Comparably

Taxpayer Information Henderson Nv

Pros And Cons Of Living In North Las Vegas Nv Retirebetternow Com

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Superior Realty Full Charge Bookkeeper Resume Sample Resumehelp

Marriott Hotels In Las Vegas Marriott Bonvoy

Nevada Tax Rates And Benefits Living In Nevada Saves Money

15 Honest Pros Cons Of Living In Las Vegas Nevada

2510 E Tropicana Ave Las Vegas Nv 89121 Loopnet

Should Turning 65 Exempt You From Property Taxes This Measure Would